Property Tax Rate Glendale Ca . California property tax calculations with annual assessment increases up. the revenue section is responsible for monitoring the city’s major revenue sources, such as property taxes, sales taxes and. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the city of glendale receives about 13.5 cents for every $1 paid in ad valorem property taxes. Property taxes are just one. Compare your rate to the california and u.s. glendale is located in los angeles county, and the average effective property tax rate is 0.72%. calculate property taxes based on assessed value and a tax rate. How much you pay in property. This means that residents of glendale. click on a state to find the most current information about property tax rates, exemptions, collection dates and assessments.

from taxfoundation.org

Compare your rate to the california and u.s. calculate property taxes based on assessed value and a tax rate. This means that residents of glendale. Property taxes are just one. How much you pay in property. click on a state to find the most current information about property tax rates, exemptions, collection dates and assessments. glendale is located in los angeles county, and the average effective property tax rate is 0.72%. the revenue section is responsible for monitoring the city’s major revenue sources, such as property taxes, sales taxes and. California property tax calculations with annual assessment increases up. calculate how much you'll pay in property taxes on your home, given your location and assessed home value.

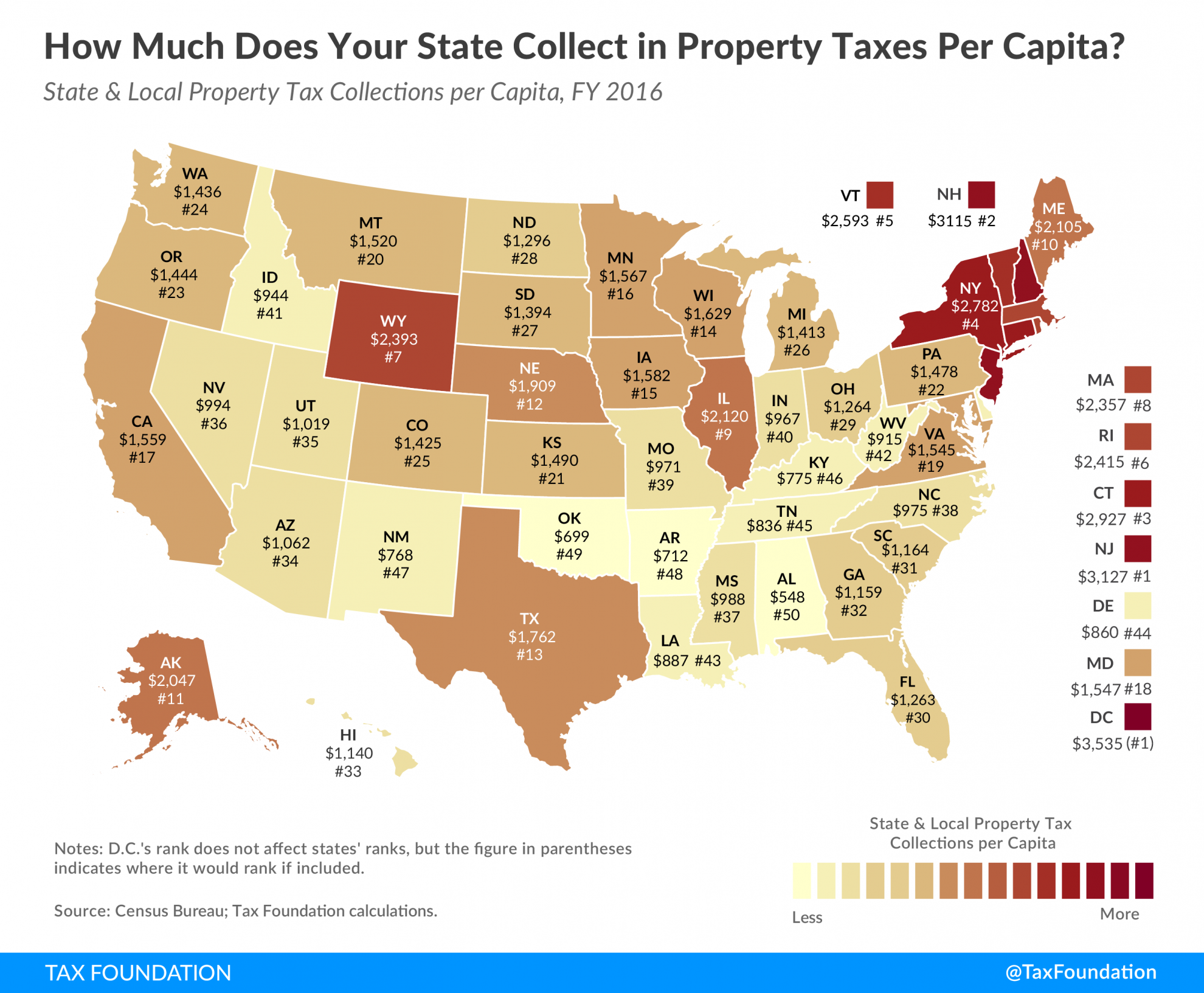

Property Taxes Per Capita State and Local Property Tax Collections

Property Tax Rate Glendale Ca the city of glendale receives about 13.5 cents for every $1 paid in ad valorem property taxes. the city of glendale receives about 13.5 cents for every $1 paid in ad valorem property taxes. calculate property taxes based on assessed value and a tax rate. How much you pay in property. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the revenue section is responsible for monitoring the city’s major revenue sources, such as property taxes, sales taxes and. click on a state to find the most current information about property tax rates, exemptions, collection dates and assessments. This means that residents of glendale. glendale is located in los angeles county, and the average effective property tax rate is 0.72%. Compare your rate to the california and u.s. Property taxes are just one. California property tax calculations with annual assessment increases up.

From madonnawgrete.pages.dev

How Much Is Property Tax In California 2024 Shel Carolyn Property Tax Rate Glendale Ca click on a state to find the most current information about property tax rates, exemptions, collection dates and assessments. calculate property taxes based on assessed value and a tax rate. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the city of glendale receives about 13.5 cents. Property Tax Rate Glendale Ca.

From issuu.com

PROPERTY TAX CALCULATOR by Cutmytaxes Issuu Property Tax Rate Glendale Ca calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the revenue section is responsible for monitoring the city’s major revenue sources, such as property taxes, sales taxes and. Property taxes are just one. How much you pay in property. California property tax calculations with annual assessment increases up. . Property Tax Rate Glendale Ca.

From wallethub.com

Property Taxes by State Property Tax Rate Glendale Ca Compare your rate to the california and u.s. the city of glendale receives about 13.5 cents for every $1 paid in ad valorem property taxes. Property taxes are just one. How much you pay in property. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. click on a. Property Tax Rate Glendale Ca.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation Property Tax Rate Glendale Ca click on a state to find the most current information about property tax rates, exemptions, collection dates and assessments. calculate property taxes based on assessed value and a tax rate. How much you pay in property. the revenue section is responsible for monitoring the city’s major revenue sources, such as property taxes, sales taxes and. Property taxes. Property Tax Rate Glendale Ca.

From www.topmauihomes.com

Property Taxes Property Tax Rate Glendale Ca Property taxes are just one. calculate property taxes based on assessed value and a tax rate. This means that residents of glendale. Compare your rate to the california and u.s. the revenue section is responsible for monitoring the city’s major revenue sources, such as property taxes, sales taxes and. How much you pay in property. California property tax. Property Tax Rate Glendale Ca.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Property Tax Rate Glendale Ca the city of glendale receives about 13.5 cents for every $1 paid in ad valorem property taxes. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. California property tax calculations with annual assessment increases up. Compare your rate to the california and u.s. Property taxes are just one. . Property Tax Rate Glendale Ca.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Property Tax Rate Glendale Ca How much you pay in property. glendale is located in los angeles county, and the average effective property tax rate is 0.72%. calculate property taxes based on assessed value and a tax rate. This means that residents of glendale. the city of glendale receives about 13.5 cents for every $1 paid in ad valorem property taxes. California. Property Tax Rate Glendale Ca.

From www.civicfed.org

2015 Effective Property Tax Rates in the Collar Counties The Civic Property Tax Rate Glendale Ca the revenue section is responsible for monitoring the city’s major revenue sources, such as property taxes, sales taxes and. This means that residents of glendale. glendale is located in los angeles county, and the average effective property tax rate is 0.72%. calculate property taxes based on assessed value and a tax rate. How much you pay in. Property Tax Rate Glendale Ca.

From exoahnwtg.blob.core.windows.net

How Much Is Personal Property Tax In California at Alison Hutchinson blog Property Tax Rate Glendale Ca Compare your rate to the california and u.s. Property taxes are just one. How much you pay in property. California property tax calculations with annual assessment increases up. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the revenue section is responsible for monitoring the city’s major revenue sources,. Property Tax Rate Glendale Ca.

From realwealth.com

How to Calculate Capital Gains Tax on Real Estate Investment Property Property Tax Rate Glendale Ca click on a state to find the most current information about property tax rates, exemptions, collection dates and assessments. glendale is located in los angeles county, and the average effective property tax rate is 0.72%. the city of glendale receives about 13.5 cents for every $1 paid in ad valorem property taxes. the revenue section is. Property Tax Rate Glendale Ca.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Property Tax Rate Glendale Ca This means that residents of glendale. the revenue section is responsible for monitoring the city’s major revenue sources, such as property taxes, sales taxes and. glendale is located in los angeles county, and the average effective property tax rate is 0.72%. calculate property taxes based on assessed value and a tax rate. Compare your rate to the. Property Tax Rate Glendale Ca.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Property Tax Rate Glendale Ca click on a state to find the most current information about property tax rates, exemptions, collection dates and assessments. the city of glendale receives about 13.5 cents for every $1 paid in ad valorem property taxes. This means that residents of glendale. calculate property taxes based on assessed value and a tax rate. Compare your rate to. Property Tax Rate Glendale Ca.

From www.yoursurvivalguy.com

The Highest Property Taxes in America Your Survival Guy Property Tax Rate Glendale Ca calculate how much you'll pay in property taxes on your home, given your location and assessed home value. calculate property taxes based on assessed value and a tax rate. How much you pay in property. glendale is located in los angeles county, and the average effective property tax rate is 0.72%. the city of glendale receives. Property Tax Rate Glendale Ca.

From www.primecorporateservices.com

Comparing Property Tax Rates State By State Prime Corporate Services Property Tax Rate Glendale Ca calculate how much you'll pay in property taxes on your home, given your location and assessed home value. California property tax calculations with annual assessment increases up. calculate property taxes based on assessed value and a tax rate. glendale is located in los angeles county, and the average effective property tax rate is 0.72%. Property taxes are. Property Tax Rate Glendale Ca.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Property Tax Rate Glendale Ca Property taxes are just one. the city of glendale receives about 13.5 cents for every $1 paid in ad valorem property taxes. Compare your rate to the california and u.s. click on a state to find the most current information about property tax rates, exemptions, collection dates and assessments. California property tax calculations with annual assessment increases up.. Property Tax Rate Glendale Ca.

From www.mortgagecalculator.org

Median United States Property Taxes Statistics by State States With Property Tax Rate Glendale Ca glendale is located in los angeles county, and the average effective property tax rate is 0.72%. calculate property taxes based on assessed value and a tax rate. How much you pay in property. California property tax calculations with annual assessment increases up. Property taxes are just one. calculate how much you'll pay in property taxes on your. Property Tax Rate Glendale Ca.

From jvccc.org

Property Tax Rate Comparison Jersey Village Neighbors Property Tax Rate Glendale Ca This means that residents of glendale. How much you pay in property. calculate property taxes based on assessed value and a tax rate. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the city of glendale receives about 13.5 cents for every $1 paid in ad valorem property. Property Tax Rate Glendale Ca.

From www.expressnews.com

Map Keep current on Bexar County property tax rate increases Property Tax Rate Glendale Ca calculate property taxes based on assessed value and a tax rate. the city of glendale receives about 13.5 cents for every $1 paid in ad valorem property taxes. California property tax calculations with annual assessment increases up. Property taxes are just one. How much you pay in property. click on a state to find the most current. Property Tax Rate Glendale Ca.